ny paid family leave tax 2021

The new york workers compensation board announced that the employee contribution rate for paid family leave pfl insurance will remain at 0511 for 2022 up to the current statewide average weekly wage saww of 159457 capped at the. The weekly contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year.

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

This is 9675 more than the maximum weekly benefit for 2021.

. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. New Yorks states Paid Family Leave PFL program provides workers with job-protected paid leave to bond with a new child care for a loved one with a serious health condition or to help relieve family pressures when someone is. For 2021 the contribution rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York The maximum.

In 2021 employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage. Use the calculator below to view an estimate of your deduction. The contribution rate for New Yorks family-leave insurance program is to increase for 2021 the state Paid Family Leave department said Sept.

PdfFiller allows users to edit sign fill and share all type of documents online. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. 0511 of wages Maximum Employee Contribution.

New York designed Paid Family Leave to be easy for employers to implement with three key tasks. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld. This amount is subject to contributions up to the annual wage base.

Employers may collect the cost of Paid Family Leave through payroll deductions. But the benefits also get better. Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported.

In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective. 2021 Paid Family Leave Rate Increase. The maximum 2021 annual contribution will.

Up to 12 Weeks of Leave. Weekly Benefit of employee weekly wage 60. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. The New York State Department of Financial Services recently announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be 511100 of an employees weekly wage up to the statewide AWW.

1 Obtain Paid Family Leave coverage. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Benefits for 2021 67 Wage Benefits Receive 67 of your average weekly wage up to a cap. Ad Register and Subscribe Now to work on your Hartford App for NY Paid Family Leave Benefits. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program.

Requirements for other types of employers are. 2 Collect employee contributions to pay for their coverage. Ny paid family leave tax 2021.

2021 Paid Family Leave Payroll Deduction Calculator. Paid Family Leave may also be available for use in situations when you or your minor dependent child are under an order of quarantine or isolation due to COVID-19. New York Paid Family Leave Updates For 2022 Paid Family Leave.

New York State Paid Family Leave Cornell University Division Of Human Resources. What category description should I choose for this box 14 entry. Maximum benefit duration will be 12-weeks.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Maximum weekly benefit rate will be 67 of the employees Average Weekly Wage capped at 67 of the NYSAWW max of 97161 per week in 2021 Download a copy of the official announcement. This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction.

It continues to get more costly for employees. For 2021 and beyond. The contribution generally must be deducted from each employees wages although.

The maximum annual contribution is 42371. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. 1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program.

Family Leave effective January 1 2021. Here a primer on New Yorks 2021 Paid Family Leave Program. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy so working families would not have to choose between caring for their loved ones and risking their economic security. Statewide Average Weekly Wage SAWW Maximum Weekly Benefit. On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No.

See PaidFamilyLeavenygovCOVID19 for full details. 2021 marks the last year of the 4-year phase-in of the Paid Family Leave benefits in New York. In 2021 these deductions are capped at the annual maximum of 38534.

Generally your AWW is the average of your last eight weeks of pay prior to starting Paid Family Leave including bonuses and commissions. NEW YORK PAID FAMILY LEAVE 2020 vs. On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries.

You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. The New York Department of Financial Services DFS has announced the maximum employee-contribution rate for 2021. The maximum weekly benefit for 2021 is 97161.

The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a. 1 the contribution rate is to be 0511 up from 027 in 2020 the department said on its website. NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions.

Length of Paid Leave. We are now in the third year of New Yorks Paid Family Leave Program. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020.

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

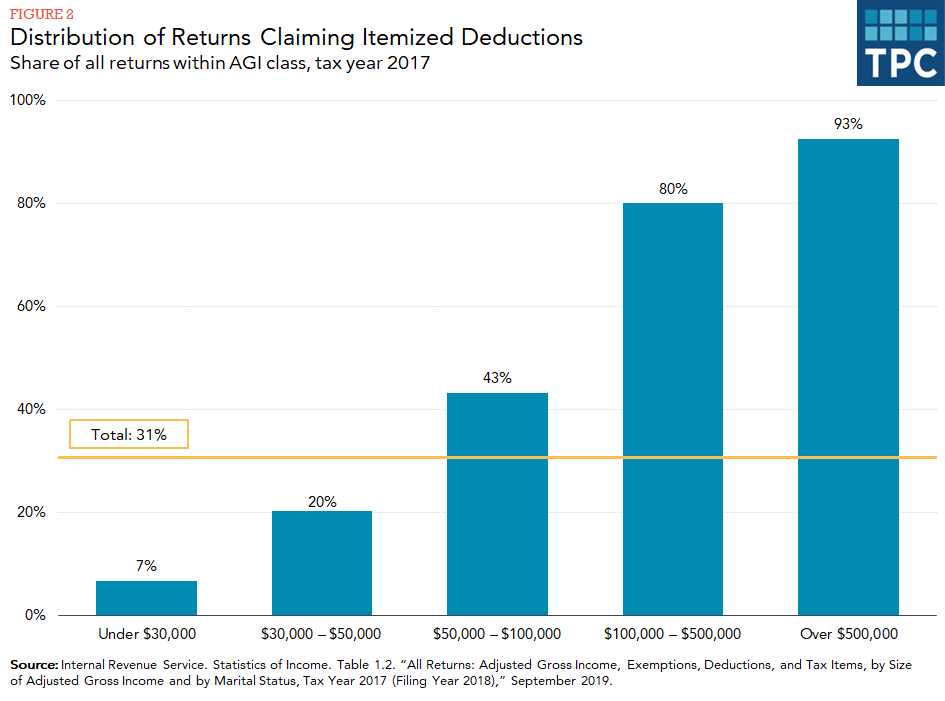

What Are Itemized Deductions And Who Claims Them Tax Policy Center

It S Tax Season Will My Alimony Be Tax Deductible In 2021

The Irs Volunteer Income Tax Assistance Vita And The Tax Counseling For The Elderly Tce Programs Prepare Tax Returns Tax Return Tax Preparation Income Tax

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

How To Get Your Maximum Tax Refund Credit Com

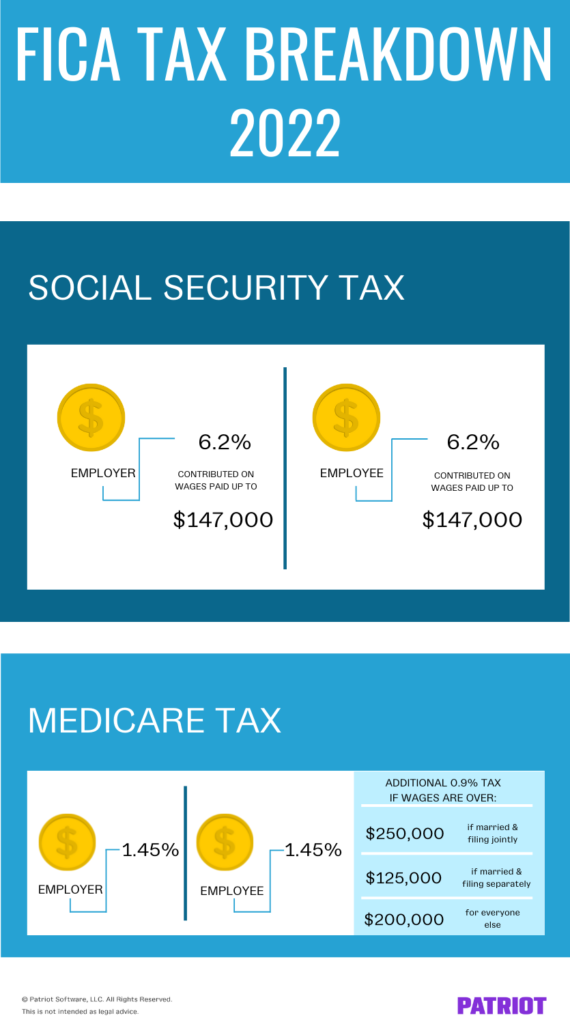

What Is Fica Tax Contribution Rates Examples

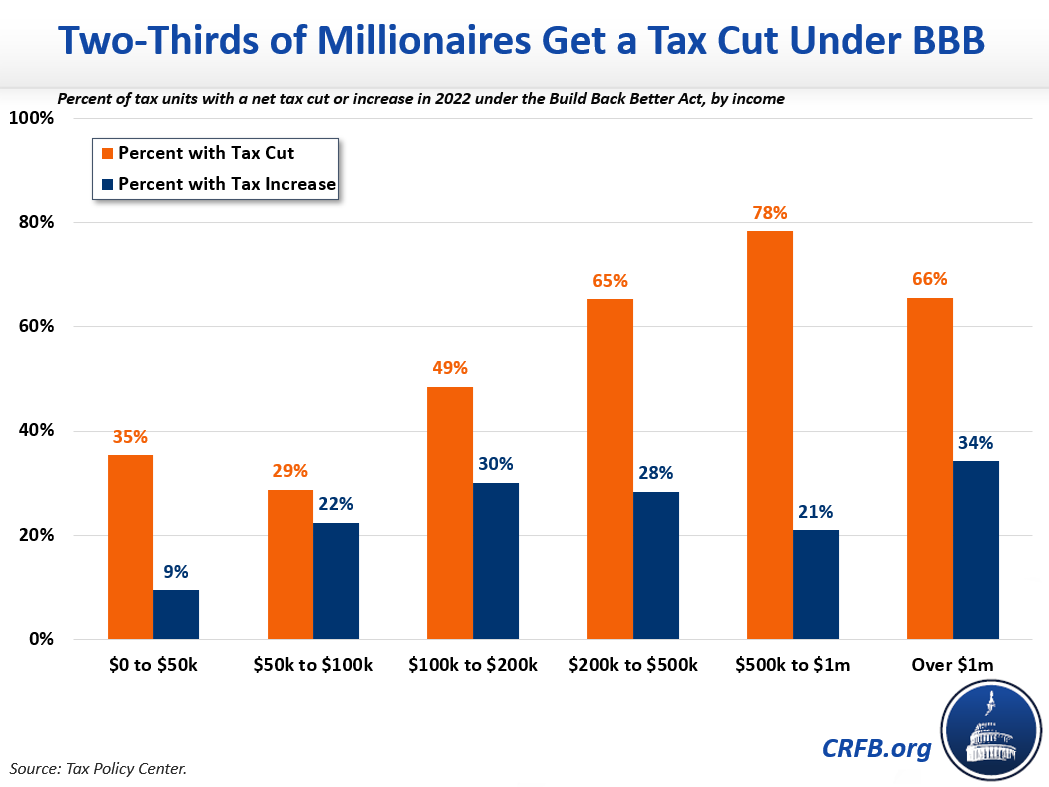

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

Inspirational Travel Quotes For Every Kind Of Adventure Travel Quotes Inspirational Best Travel Quotes Funny Travel Quotes

401 K Inheritance Tax Rules Estate Planning

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Working Moms Are Struggling Here S What Would Help Published 2021 Working Moms Working Mother Working Fathers

Updated Irs Releases Guidance On Arpa Paid Leave Tax Credits Sequoia

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

What To Do About An Overtalker Published 2019 In 2021 Compulsive Behavior You At Work Dealing With A Narcissist